How to trade Futures on BingX

BingX Perpetual Futures is a futures product settled with cryptocurrencies that allows investors to buy long or sell short to profit from the rise or fall of the cryptocurrency prices. The Perpetual Futures has no delivery date and never expires.

This article provides a comprehensive overview of the BingX Perpetual Futures trading page and how to place your first Perpetual Futures trade on the BingX website.

This article provides a comprehensive overview of the BingX Perpetual Futures trading page and how to place your first Perpetual Futures trade on the BingX website.

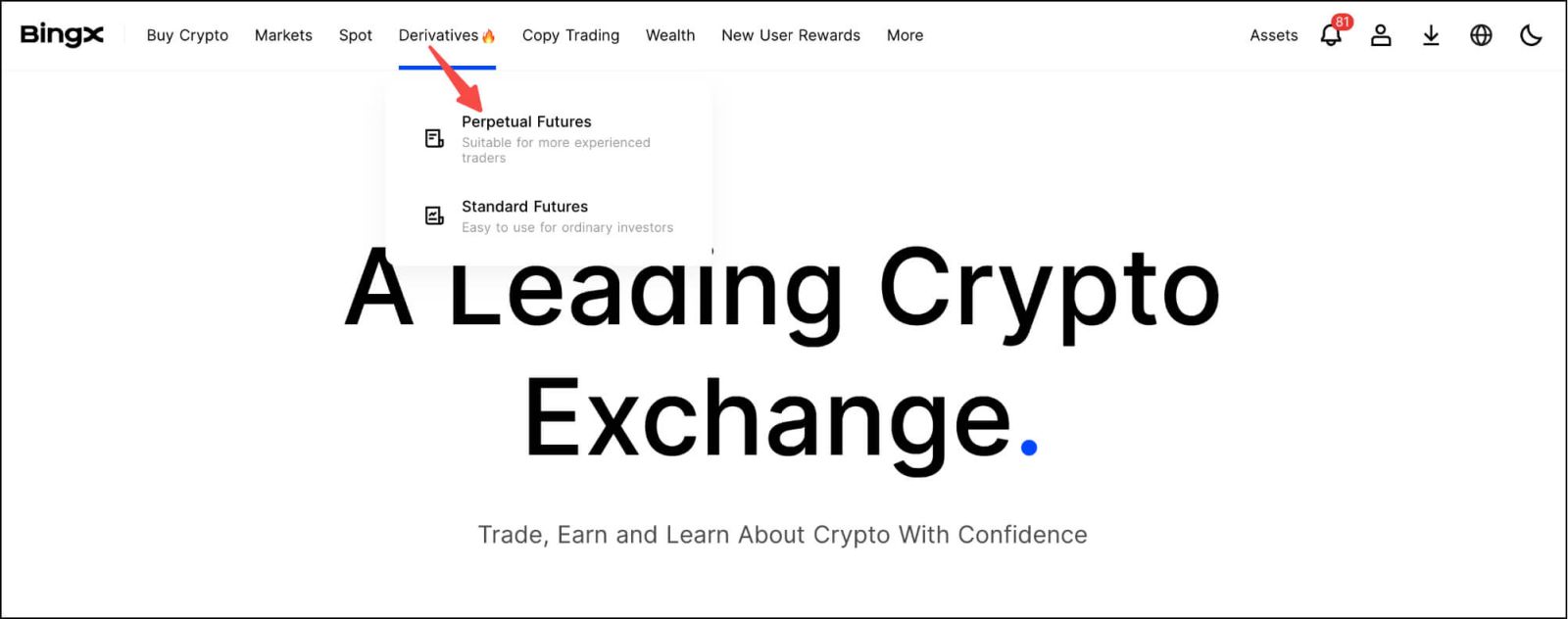

How to Access Perpetual Futures?

Log in to the BingX website, hover over "Derivatives" on the top menu bar, and select "Perpetual Futures" to enter the Perpetual Futures trading page.

How to Trade Perpetual Futures on BingX

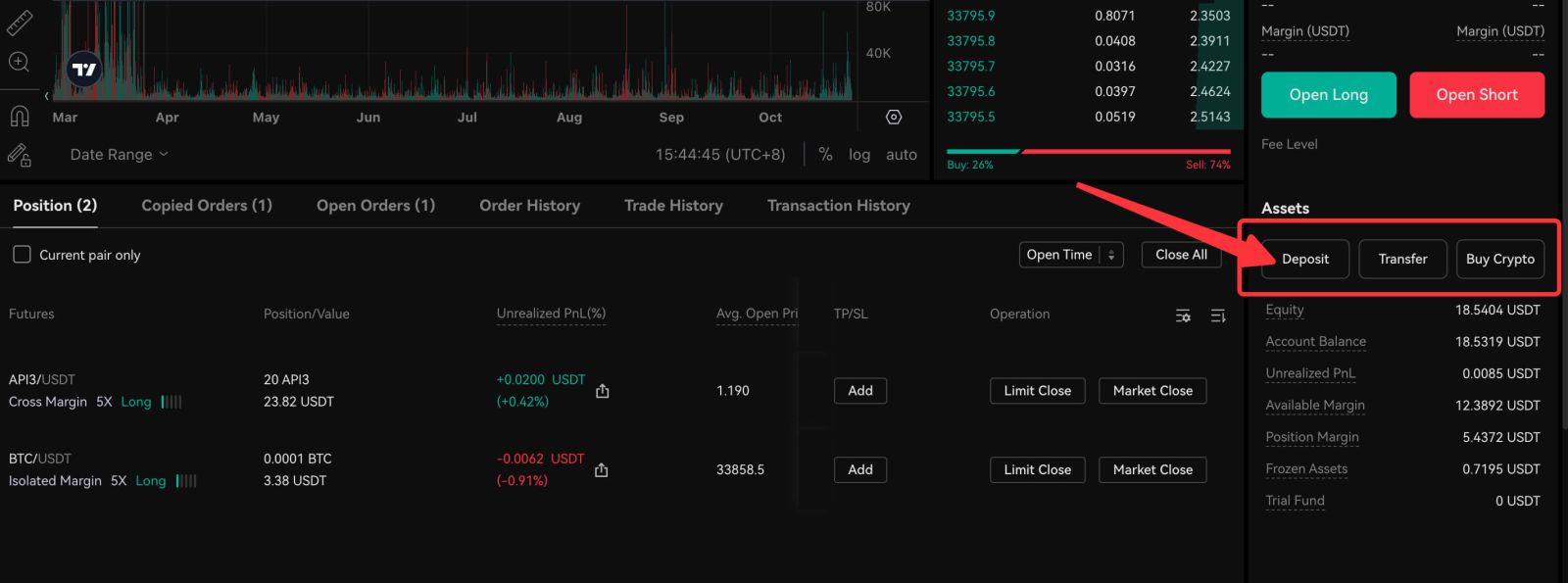

1. Top up the Futures account

Click on "Deposit", "Transfer" or "Buy Crypto" to add funds to your Futures account.1.1 Deposit: Deposit assets via the blockchain directly to Perpetual Futures Account.

1.2 Transfer: Transfer funds from a Fund Account or Standard Futures Account to a Perpetual Futures Account.

1.3 Buy Crypto: Buy cryptocurrencies quickly and deposit funds to your Perpetual Futures account.

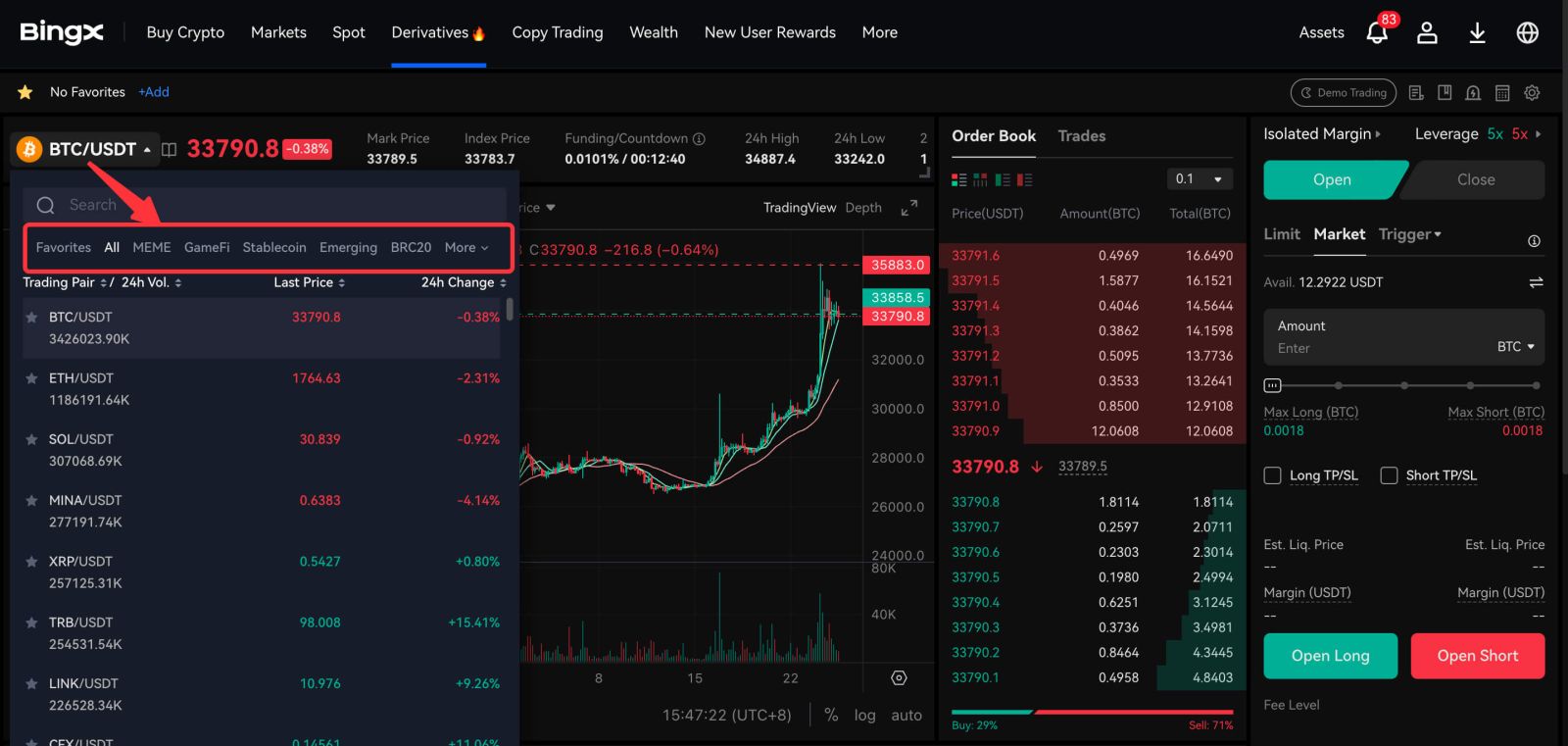

2. Open a position

2.1 Select a trading pair: Select a desired trading pair, such as BTC/USDT. You can also view the contract info in different sections according to your own needs.

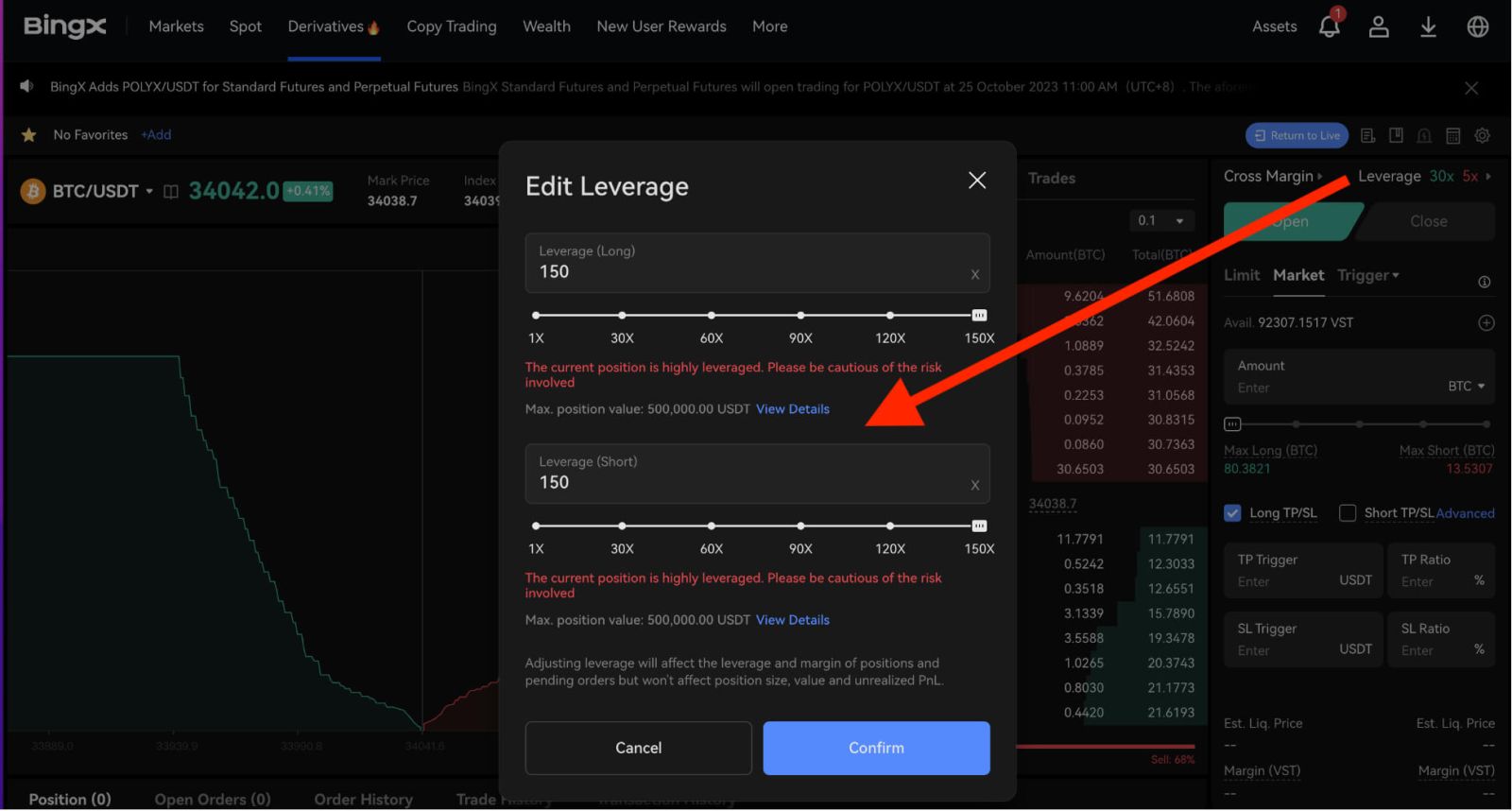

2.2 Adjust the leverage: Click on Leverage on the right side of the page (5x by default, with a maximum leverage of 150x). You can adjust the slider or enter a numerical value to set up the leverage. Please be aware that the larger your position size, the lower the leverage that you can apply, and vice versa. Higher leverage comes with a higher risk of forced liquidation.

2.3 Complete the order:

Fill in the order price and amount. Choose Open Long if you expect the price to go up and Open Short if you expect the price to go down. The default order type is Market order and you can click on it to switch to another type. BingX now supports five order types including Limit, Market, Trigger, Trailing Stop, and Post Only. For details: Perpetual Futures | Order Types

Decide a direction and place the order. Going long represents a bullish view while going short represents a bearish view. In case you need to set up TP/SL before opening a position, tick the circle in front of TP/SL and configure the settings accordingly. For details: Perpetual Futures | FAQ on TP/SL

If you want to try out trading Perpetual Futures with zero slippage, we recommend using BingX’s exclusive Guaranteed Price (GTD Price) feature. This feature will ensure that your order gets filled at your preset price without any slippage, regardless of how the market fluctuates, to safeguard your trading and avoid unnecessary losses for details: Perpetual Futures Upgrade: Exclusive Guaranteed Price Launched to Prevent Slippage Losses.

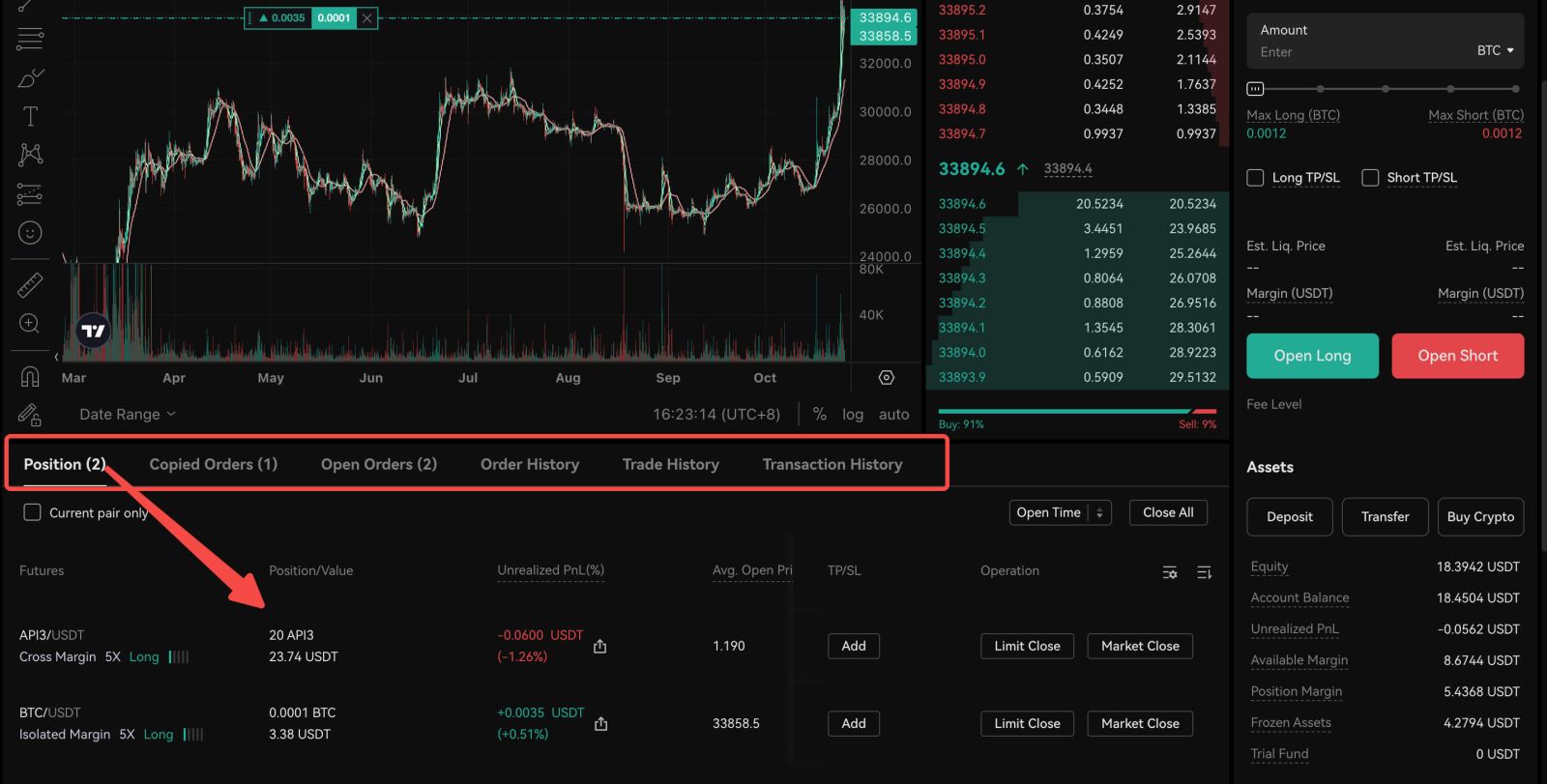

3. View the Position

Details of the filled order such as avg. position price, position size and unrealized PnL can be viewed in Position; Pending orders can be viewed in Open Orders.

3.1 Unrealized PnL: It displays the real-time unrealized profit or loss of the position. Please note that the position PnL is estimated based on the last price and does not include any trading fees or funding fees that may be generated or collected while holding the position. For details: Perpetual Futures | PnL Calculations Explained.

3.2 ROI: It refers to the percentage of unrealized PnL, displaying the return on investment (ROI) for this position in percentage format. Similar to unrealized PnL, this figure fluctuates along with the last market price.

3.3 Size: The position size refers to the amount of the contract, denominated in the underlying currency of the contract. To control the risk of high leverage, your max. position limit is related to the leverage multiplier. Use lower leverage to get a larger position limit. For details: Perpetual Futures - Trading Rules

3.4 Avg. Position Price: The average entry price of the position. Avg. Position Price = The total value of the contract (USDT) / the total size of the contract.

3.5 Margin: Position margin refers to the amount of margin collateralized to maintain the position. In the Isolated Margin mode, investors may lose the entire margin of the position (excluding funding fees) once forced liquidation occurs. Investors can manually add more funds to the position as initial margin to lower the liquidation risk. Please note that once the initial margin reaches the position value, investors will not be able to add any additional margin.

3.6 Mark Price: The mark price is used for calculating all unrealized PnL to prevent market manipulation. The perpetual futures price of a contract equals to or close to the spot price. For details: Perpetual Futures | Mark Price Index Price.

3.7 Risk: Be aware of the risk level when holding a position to prevent forced liquidation. You can also monitor the position in the auto-deleveraging (ADL) queue under this section. It’s especially important to keep an eye on this point during high volatility.

3.8 Est. Liq. Price: The estimated liquidation price can be calculated based on "Margin ≤ Maintenance Margin + Taker Fees". BingX adopts Dual-Price Mechanism, where a user’s position is only liquidated when both the last price and the mark price reach the estimated liquidation price. For details: Perpetual Futures | New Dual-Price Mechanism.

When forced liquidation occurs, users will lose the entire margin of the position (for Cross Margin mode, users will lose the entire margin of the corresponding account). Users are advised to pay close attention to any changes in the mark price and the estimated liquidation price to avoid forced liquidation. For details: Perpetual Futures | Forced Liquidation Rules.

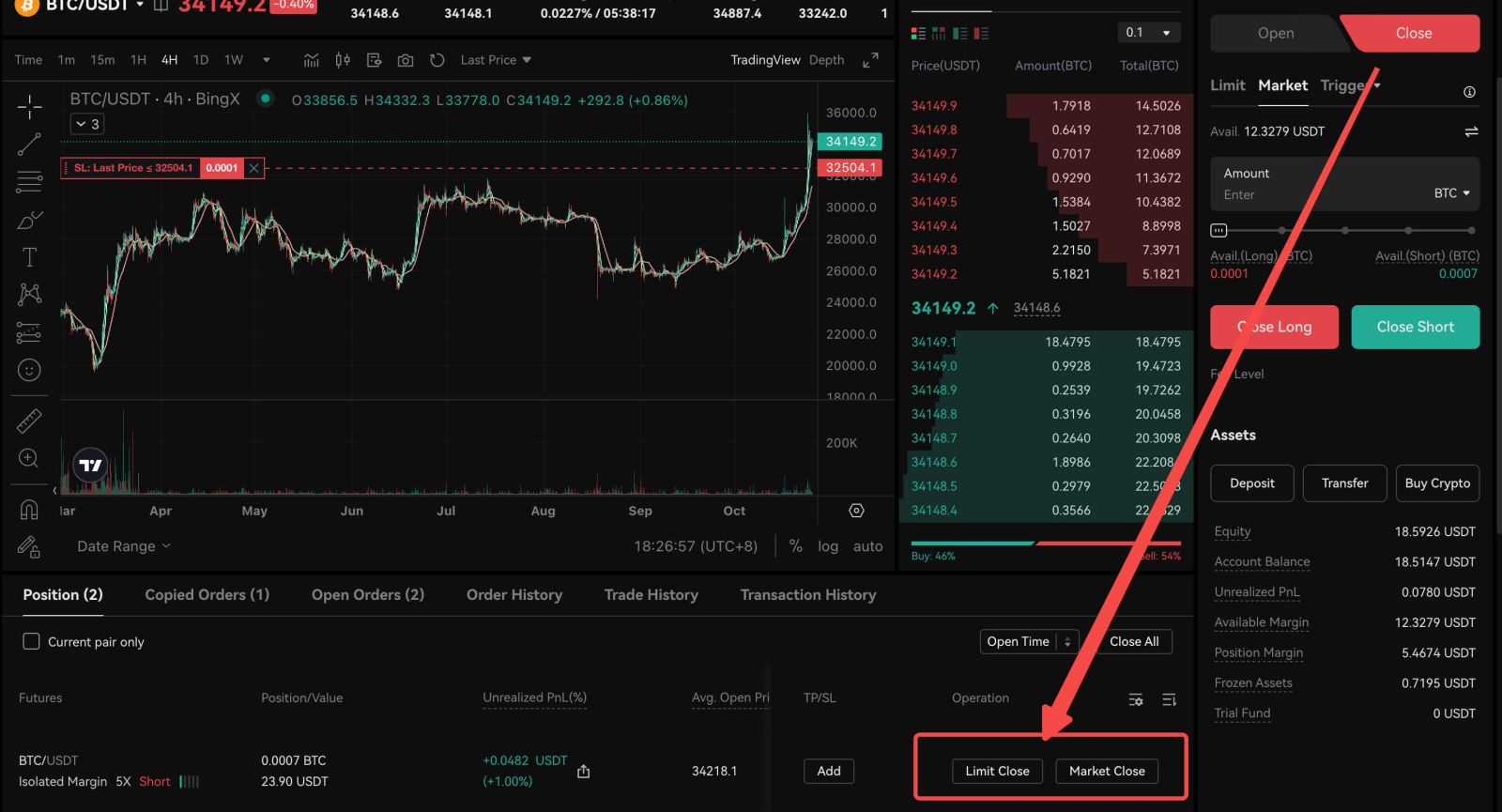

4. Close a position

Tap on "Close" and select a direction to close the position.

4.1 Settlement: Including trading fees and funding fees. For details: Perpetual Futures | Fee Schedule.

4.2 Reverse a position: Users can reverse a position by closing the current position and creating a same-size position of the opposite direction quickly in response to market changes.

Other Modules on the Perpetual Futures Page

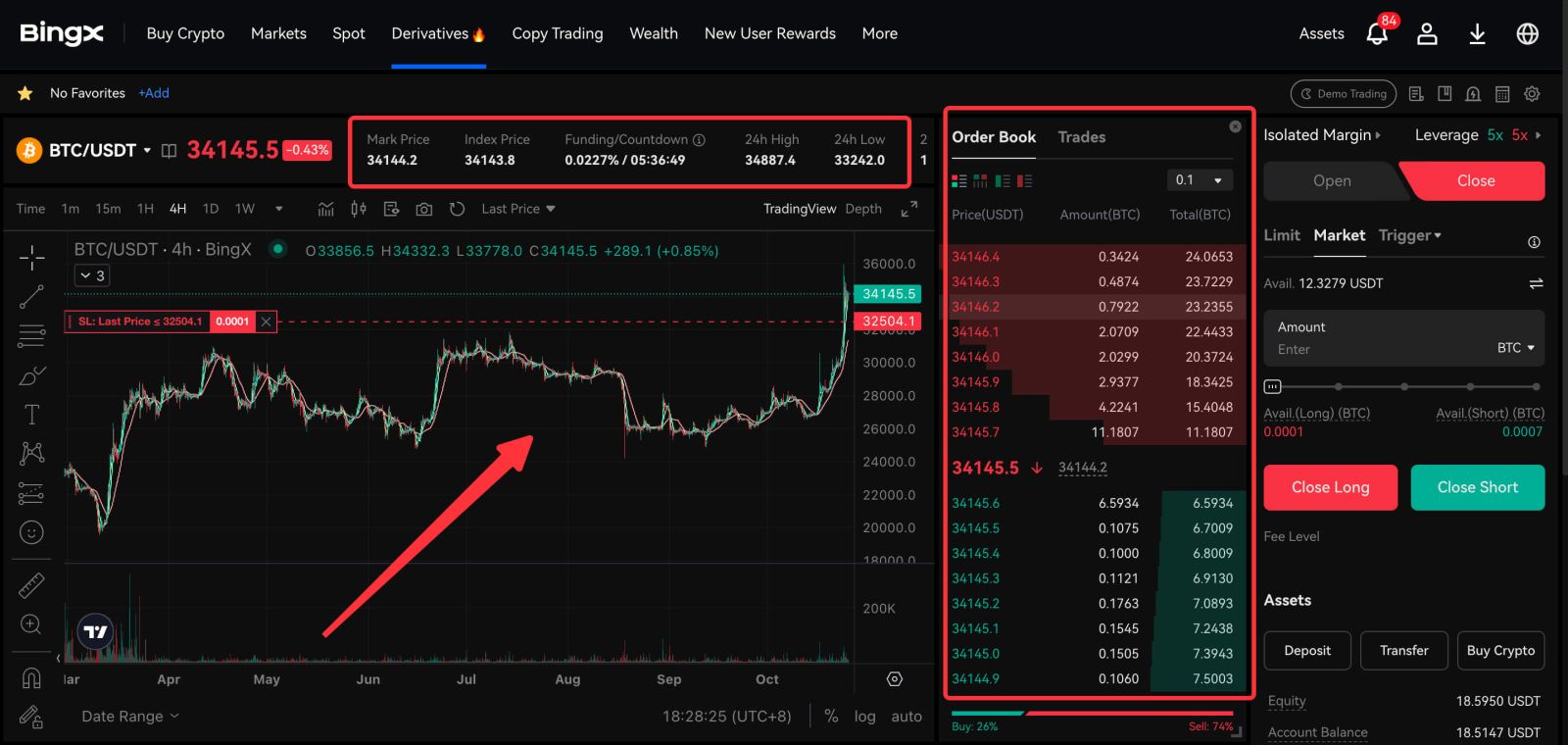

1. Funding rate and market-related data

- This section provides information such as mark price, index price, funding/countdown, 24-h high/low, and 24-h trading volume/trading amount. Be particularly mindful of the Mark Price, as positions are closed based on it.

- Real-time order book data: Allows you to view the latest trade information in real time.

- Market trends: Monitor market trends and price movements for specific cryptocurrencies

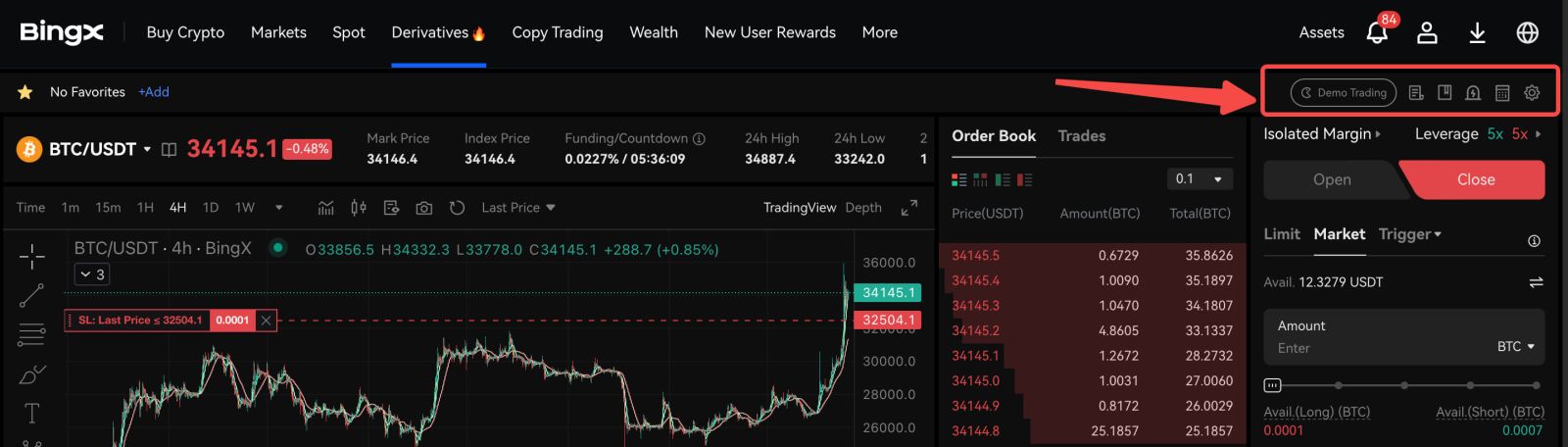

2. More Futures features

Click on the icons on the right panel and you’ll be able to access more features of the BingX Perpetual Futures, such as Demo Trading, Info, Futures Guideline, Price Alert, Calculator, and Preferences.

BingX Official Channels

BingX App: https://bingx.com/download/

BingX Web: https://bingx.com

Telegram: https://t.me/BingXOfficial

Twitter: https://twitter.com/BingXOfficial

YouTube: https://www.youtube.com/c/bingx

Conclusion: Mastering Futures Trading on BingX for Strategic Growth

Futures trading on BingX offers traders an opportunity to amplify potential returns and navigate both rising and falling markets. With robust features, adjustable leverage, and a user-friendly interface, BingX provides the tools needed for effective and strategic trading.By following these steps and continuously educating yourself on market dynamics, you can confidently trade futures and enhance your overall crypto trading experience.